Credit card bills nowadays reference IGST charges if you closely check the transactions. Whether it is a credit card from ICICI, SBI or HDFC, or any bank, it is mandatory to include GST on specific transactions; that is why you see charges labelled like IGST-VPS RATE-18.0, IGST DB, IGST CI, all taxed at 18 percent as of 2023. Here, we mainly talk about IGST debits in HDFC credit card statements, but anyone going through their credit card bill for the first time or after a card renewal, taking an EMI plan, etc., would see it and wonder what this charge IGST is about. If you are a credit card user, read more about IGST charges on credit cards, how banks calculate this amount, and for what all transactions it is applicable.

Why there is IGST charge in credit card EMI/ service charge fees?

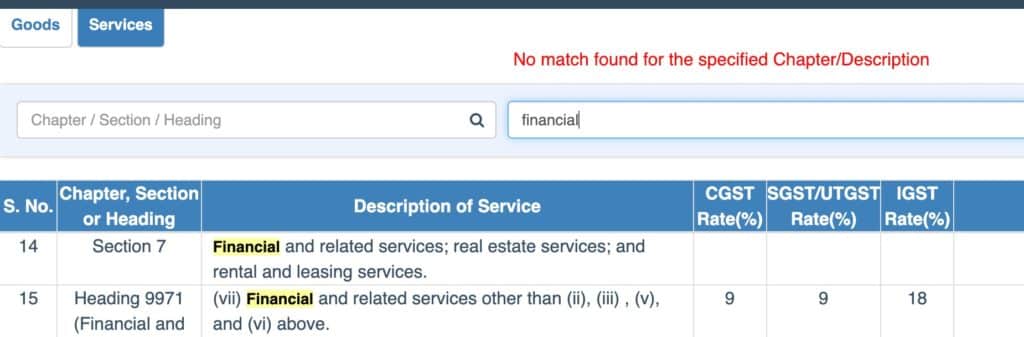

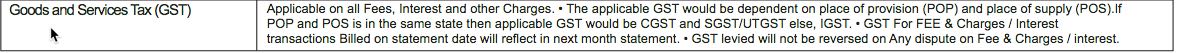

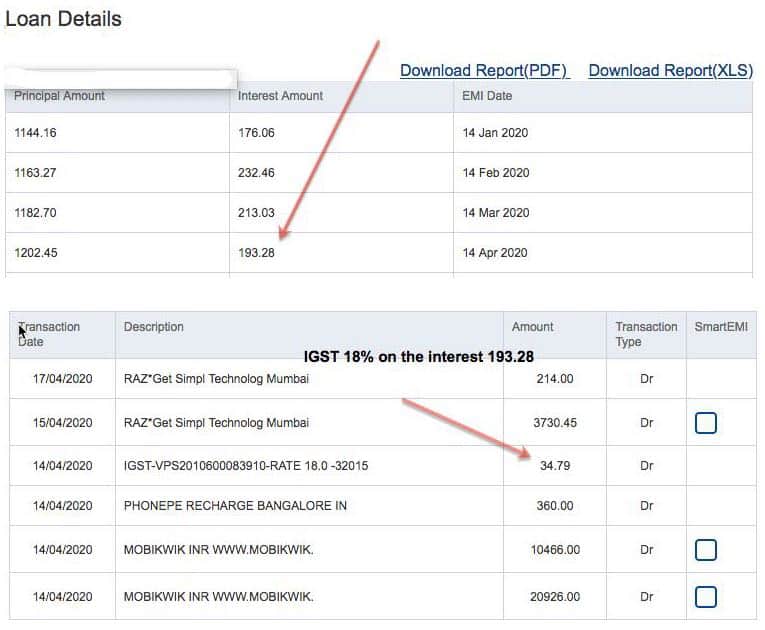

GST is applicable to financial services, and the tax rate was increased to 18 percentage a few years ago. Regarding banking services, especially credit cards, the interest part of EMIs and the fee amount charged for most services come under IGST. Even for the instalments of No Cost EMI’s, the monthly Interest part is taxed at 18% and will reflect on your credit card bill as IGST VPS, IGST DB, IGST CI, and GST charges.

IGST collected by banks is submitted to the GST department, which divides it between the central and state governments at 9% each. Let’s look at all transactions IGST is charged at 18% in the credit card sector.

- Interest component of all EMI instalments, including no cost EMIs and cash loans above or within credit limit, unless otherwise specified.

- Credit Card renewal and joining fees.

- 18% of services fees like FCY Mark-up, finance charges, late fees, EMI processing fee, etc.

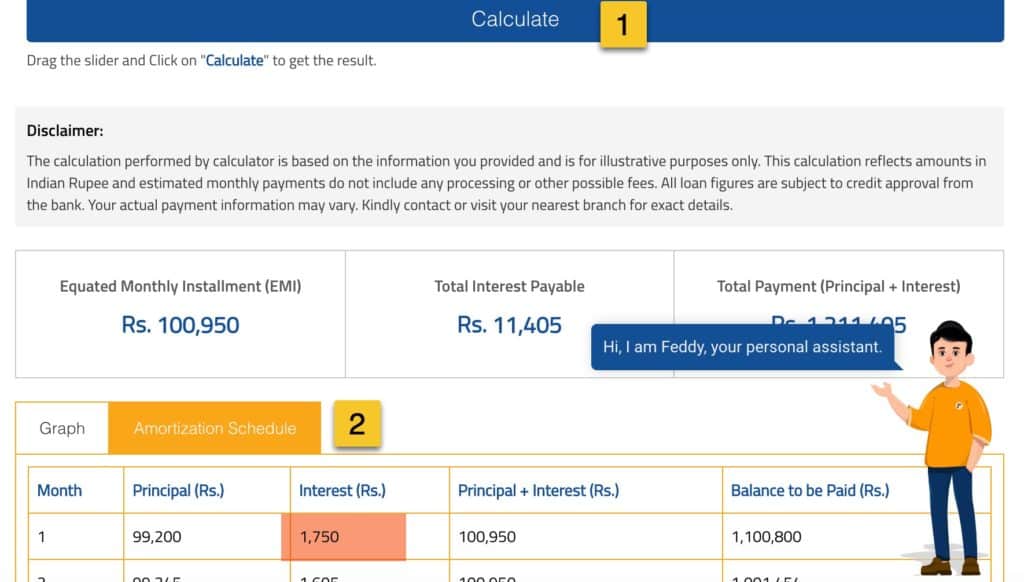

Calculating the impact of IGST on your credit card EMI or a related fee is simple – just take the interest component of your monthly instalment using a tool like the Federal Bank EMI calculator.

For that, put your credit card EMI details, calculate and then take the amortization schedule as shown in the screenshot. Here, take 18% of the interest amount of 1750 as highlighted, which is 315 and will come in your first month’s bill as IGST charges.

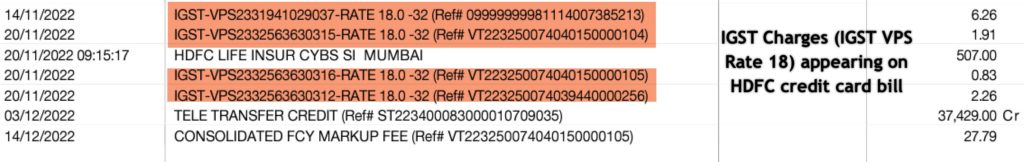

IGST-VPS RATE 18.0 on HDFC Bank Credit card statement

I came across the IGST VPS Rate-18.0 entries when I was checking my billing history on HDFC netbanking site. To my surprise, it even appeared in the unbilled section even though I didn’t use the credit card on that month. I did a background check on this, and finally, I found the reason for having IGST VPS charges on HDFC credit cards.

- The IGST-VPS at rate 18.0 percentage is a service charge as per the new integrated goods and services tax system in India.

- IGST-VPS charges are only applicable to the Interest part your HDFC credit card EMIs.

- Hence, a rate of 18% applies to interest component of your Insta Loan, Insta Jumbo Loan*, Smart EMI and other loan products under the credit card.

- Sometimes you may also get IGST-VPS debits for late payments and processing fees related to credit card loans.

- HDFC and other banks do not charge IGST on other regular transactions you make through the card.

I found the details of IGST rates on HDFC credit card from the official site. From July 2017, HDFC charges GST at 18.0 percent on specific transactions. Again, it is clear from the screenshot that the IGST rates, if applicable, reflect on the statement, only in the next billing cycle.

Finding the source of IGST-VPS on HDFC Bank credit card bill

The main reason for having IGST-VPS in your HDFC credit card bill is the presence loans and their EMI’s mapped to your account. For this reason, we have to check our existing credit card loans to locate the source of IGST-VPS charges.

Login to HDFC credit card section on Netbanking site. Now, open “Loan Details” under “Enquire” section in the sidebar. As shown in the video, select your card number and proceed. The site will list all your existing EMIs. Click on one and see the schedule of the payment for the current month. Note-down the interest part of the EMI. Now come back to check the unbilled section for credit card. There you can see the 18% of the interest added as IGST VPS charges, as shown in the screenshot. This charge will appear your next’s month’s HDFC credit card statement.

Apart from the EMI interest, HDFC Bank charges GST on various services related to Credit Card. If you apply for Insta Loan or Dial a Smart EMI, they charge GST on the processing fee amount. IGST charge is also applicable on FCY markup fee on international transactions.

IGST charges on other bank credit cards (ICICI, SBI, AXIS, and others)

Not only HDFC but all banks collect IGST charges on their credit card bills, and you can’t do anything about it. Expect it if you have EMIs running on the card or if you did a service fee-incurring transaction in the previous statement period. However, they may use different labels to mention the same in the statement. For instance, ICICI Bank uses igst-ci@18, SBI terms it as igst db @ 18.00, and for Axis Bank, it’s just GST charges. So don’t take much stress- you don’t need to call your bank if you see an IGST amount on your bill- it’s pretty standard these days.

It Just looting public money, bull shit.

I have paid minimum amount due of the HDFC’c credit card bill first time.While second time bill generated. I have paid total amount due, hence I have cleared pending dues. No ongoing EMI. I have even seen VPS 18 reflecting in next billing cycle. Why is it so..?

I checked for the loan summary for my card, it shows the status for the loan as “closed”. Still I am getting the IGST charged. What could be the reason? What should I do to get rid of this IGST charge every month?

Thank you for this nice Sunil ke explanation.

HDFC is worst card EMI card they collect mark Fee

HDFC is looting more than the gst. Even it is declared they are taking 18% gst, but calculating the interest gst by 18%, the bill comes with more than that.

Due to Covid 19 they are not even taking any calls. Where to complaint this?

Thank you for information..I couldn’t make call to customer care in covid-19 emergency but this post helped me in understanding the IGST in hdfc credit card statement.

use HDFC CREDIT CARD FRIST TIME SEND BILL ON MAIL ID SECOND TIME BANK NOT SEND CREDIT CARD STATEMENT ON MY MAIL ID

TO STILL DATE NO ANS ON TOLL FREE NO. PL SEND ME COMP NO AND PERSONS NAME.

I had the same issue till I realised the gst charges are on atm withdrawal fees as well. It’s best to not withdraw using credit card.

I have taken zero percent interest loan on credit card emi. But gst is charged every month. Why? Is there any way out for this?

HDFC- do every month they are charged or only once in a year they will charge (IGST)..?

I only had 1 transaction in the month of Jan and closed it in the same month however they still charged me for 36 rs. I don’t have any active loan or something as of now…

HDFC Credit cards worst to have.

Very true one of worst card

Very true.

Thanks for the detailed analysis

I do have an ongoing EMI but just one. My report shows 5 IGST transactions

Even I also do not have any loans on HDFC credit card but still got 18

Do you have any on going EMI in your credit card.. If yes its applicable.. If not kindly get in touch with customer support.

I found similar charges on my HDFC credit card googled and found your website but I do not have any kind of Insta loan or anything in my account still I paid like 32 INR IGST in August and 97 INR in September.

Yeah I do use CC anywhere like for online shopping restaurants and other stuffs but no loan accounts are in my accounts.

Do you have any on going EMI in your credit card..